If you’re thinking about building a home, chances are you’ve heard plenty about interest rates. But what do they actually mean for you?

Whether you’re taking out a traditional mortgage or a construction loan, interest rates aren’t just a background detail — they directly impact how much home you can afford, your monthly payments, and how far your money will really go.

So let’s break it down together — simple, clear, and relevant to your real-life plans.

Table of Contents

First things first: what is an interest rate?

An interest rate is basically the cost of borrowing money.

When you borrow from a lender to build or buy a home, they charge a percentage (that’s the interest) on top of the amount you borrow. That percentage adds up over time.

In short:

- Higher interest rate = more cost over time

- Lower interest rate = more buying power and lower monthly payments

The ripple effect of interest rates on your mortgage or construction loan

Here’s how interest rates weave into your home loan:

📅 Your monthly payment

A higher rate increases your monthly payment — sometimes by hundreds of dollars. A small change in percentage can make a big difference in your budget.

💰 Your total cost over time

When building or buying, it’s easy to focus on the purchase price. But over the life of your loan, interest adds up significantly. A higher rate could mean paying tens of thousands more across 15–30 years.

💸 Your buying power

Higher interest rates often mean you can qualify for less. That might shift your price range — or change what’s possible for location, finishes, or square footage.

🔁 Your refinancing options

If you already have a mortgage with a higher rate, refinancing might lower your payments — but make sure to factor in closing costs and fees to see if the math works in your favor.

So… why do interest rates change?

Great question. Interest rates move based on a mix of big economic levers and personal borrower factors:

- Federal Reserve policy – They set the tone by raising or lowering the federal funds rate, which trickles down to mortgages.

- Economic trends – Inflation, employment rates, and economic growth can make rates ebb and flow.

- Bond market performance – Mortgage rates tend to follow the yield on 10-year Treasury bonds. When bond yields go up, so do home loan rates.

- Your personal profile – Credit score, loan amount, loan type, down payment — all these play a role in what rate a lender offers you.

Fixed-rate or adjustable? Here’s what to know

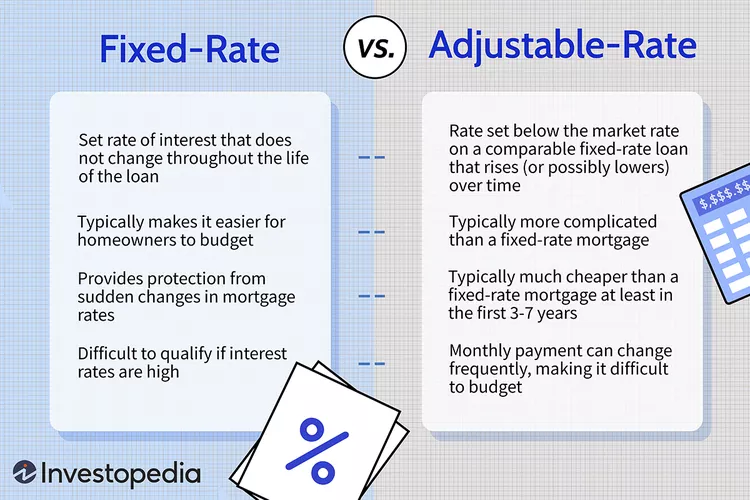

When you apply for a loan, you’ll likely choose between:

🔒 Fixed-rate mortgages

Your interest rate stays the same the entire loan. No surprises. This is great if you want predictability and plan to stay in your home long-term.

🔄 Adjustable-rate mortgages (ARMs)

Usually starts with a lower rate, but it can rise or fall after a set period. That early low rate is tempting, but make sure you’re ready if it adjusts upward in a few years. More about ARMs.

4 smart steps to navigate today’s rates

Even if the market feels unpredictable, here’s how to stay grounded:

- Know your numbers – Understand your monthly budget, credit score, and what kind of down payment you’re working with.

- Talk to more than one lender – Interest rates can vary. Get a few opinions before locking one down.

- Ask about rate locks – If you’re close to signing, locking in a good rate (for a fee) can protect you if rates rise while you finalize your plans.

- Stay informed without spiraling – Yes, interest rates can change. But with the right team and guidance, you’ll move forward with confidence.

Ready to build with clarity?

At Trawick Homes, we don’t just throw you into the deep end. We walk you step by step through the financial and construction process, with weekly updates, budget reviews, and a real conversation when you need one — not vague emails or radio silence.

If you’re exploring building a new home in Southeast Missouri and curious about construction loan options — or just trying to figure out what’s possible in today’s rate environment — reach out. We’ll explain it in plain English and help you build smarter, not more stressed.

📥 Let’s chat — Contact Trawick Homes or send us a message to walk through what your numbers, options, and timeline could look like.

P.S.

Want to keep an eye on rates yourself? Bloomberg’s mortgage rate tracker is a great daily resource.